Can you imagine having to pay a tax for the three previous years before you could cast your vote in an election? Or registering to vote for a federal election, and then discovering that doing so had not registered you to vote in a local election?

Poll taxes and dual registrations are two systems that were used in Virginia between 1876 and 1966 in order to restrict who had access to voting.

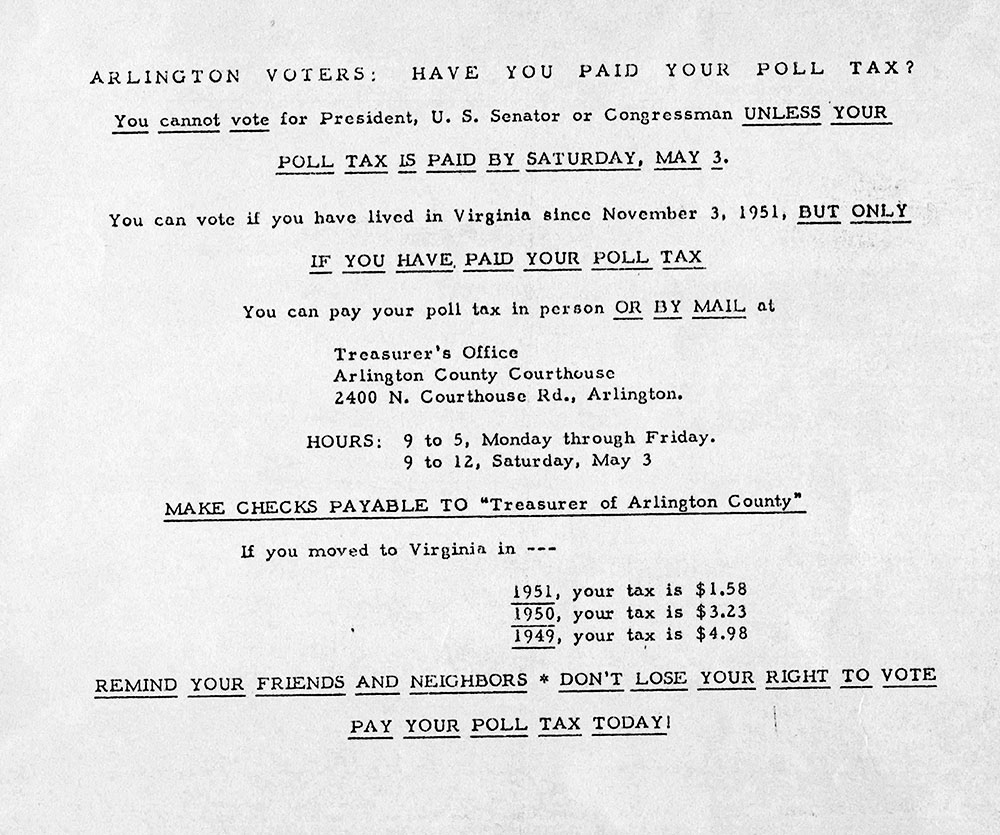

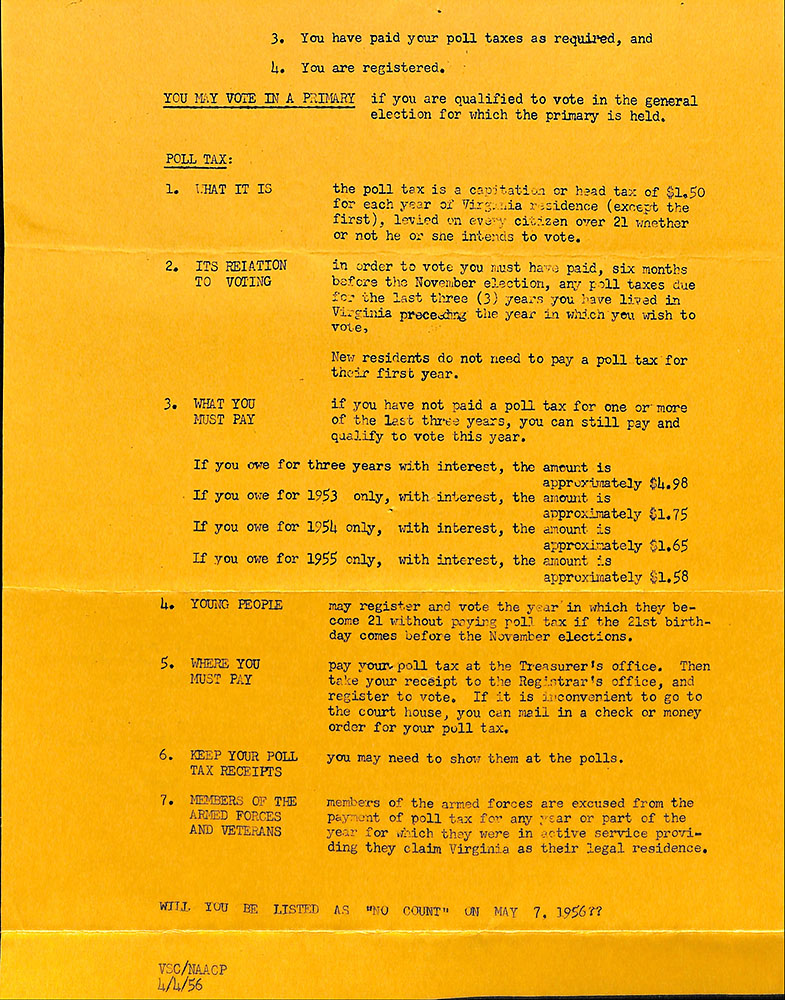

1951 flyer telling Arlington residents how to pay their poll tax in order to vote in the upcoming election

In 1876, after the Fifteenth Amendment granted African-Americans the right to vote, Virginia passed a poll tax to restrict African-American men from voting. Although this law was repealed in 1882, in 1901 the Virginia General Assembly called for a new constitution with the explicit purpose to secure the right of suffrage of the state's white men, and to take away the right to vote from anyone in the state who wasn't white.

(Read the Report of the proceedings and debates of the Constitutional Convention, state of Virginia : held in the city of Richmond June 12, 1901, to June 26, 1902)

The new constitution, which passed in 1902, reinstated the poll tax. This required voters to pay a tax of $1.50 six months prior to an election for each of the three years preceding an election. This disenfranchised approximately 90% of the black men and, counter to the intentions of those who had drafted the new constitution, nearly 50% of the white men who had previously been registered to vote in Virginia. The 1902 constitution also created an administrative structure that was difficult for any average citizen to navigate, further disenfranchising many poor men.

(American history timeline note: the 19th Amendment of the U.S. Constitution was ratified in 1920, prohibiting the states and the federal government from denying the right to vote to citizens of the United States on the basis of sex.)

While the 24th Amendment of the U.S. Constitution (ratified in 1964) outlawed poll taxes in federal elections, it did not prevent states like Virginia from continuing to require poll taxes for state and local elections. At the time five states—Alabama, Arkansas, Mississippi, Texas, and Virginia—retained poll taxes.

Virginia maintained poll taxes for state and local elections until 1966 when the Supreme Court ruled in Harper v. Virginia State Board of Elections that poll taxes were unconstitutional. Four years later, the Virginia Constitution of 1971 explicitly forbid the Virginia General Assembly from requiring poll taxes as a prerequisite to voting.

Between 1964 and 1966, when Virginians were required to pay poll taxes to vote in state and local elections but not in federal elections, Virginia instituted the dual registration system. Put in place when ratification of the 24th Amendment was all but certain, the dual registration system automatically extended federal registration to those who registered for state and local elections, but it did not automatically extend state and local registration to those who registered for federal elections. Since registering to vote and paying the poll tax were separate actions, this system disproportionately hurt those who only registered for federal elections.

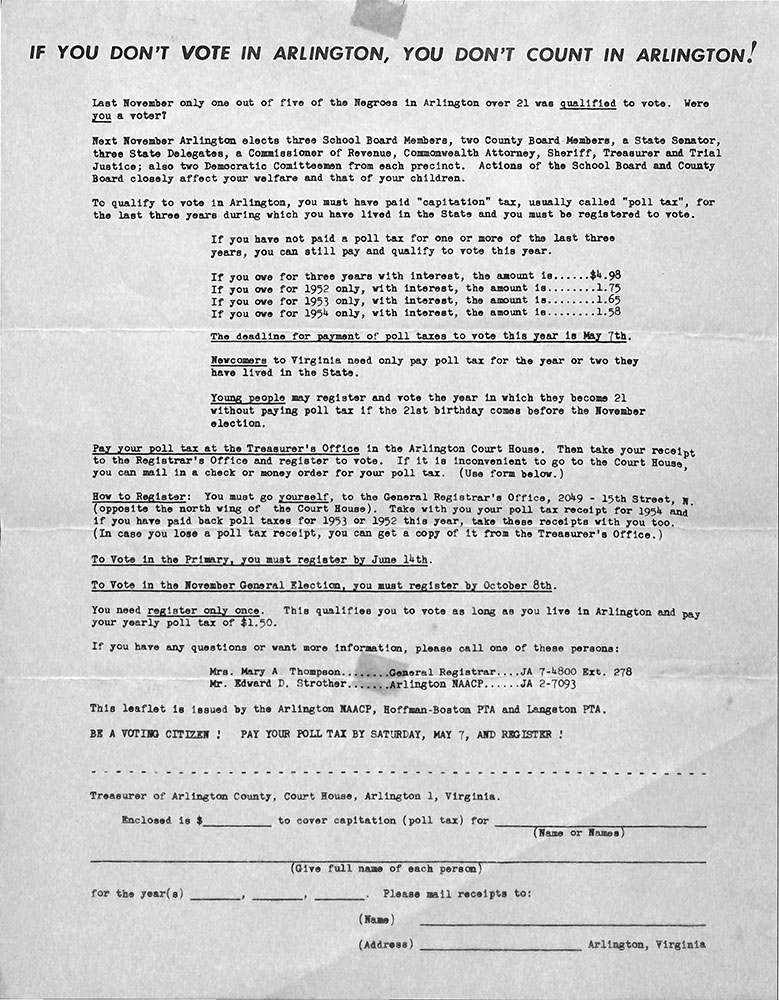

These flyers were created in the 1950s by the local NAACP, and the Hoffman-Boston and Langston PTAs. They were designed to encourage Arlington's African-American residents to pay their poll taxes in order to vote in upcoming elections, frequently using a variation of the phrase, "If you don't vote in Arlington, you don't count in Arlington."

1954 flyer on how to pay your poll tax in order to vote in upcoming School Board, County and State elections, created by the NAACP and Hoffman Boston and Langston PTAs. View item information on ProjectDAPS.

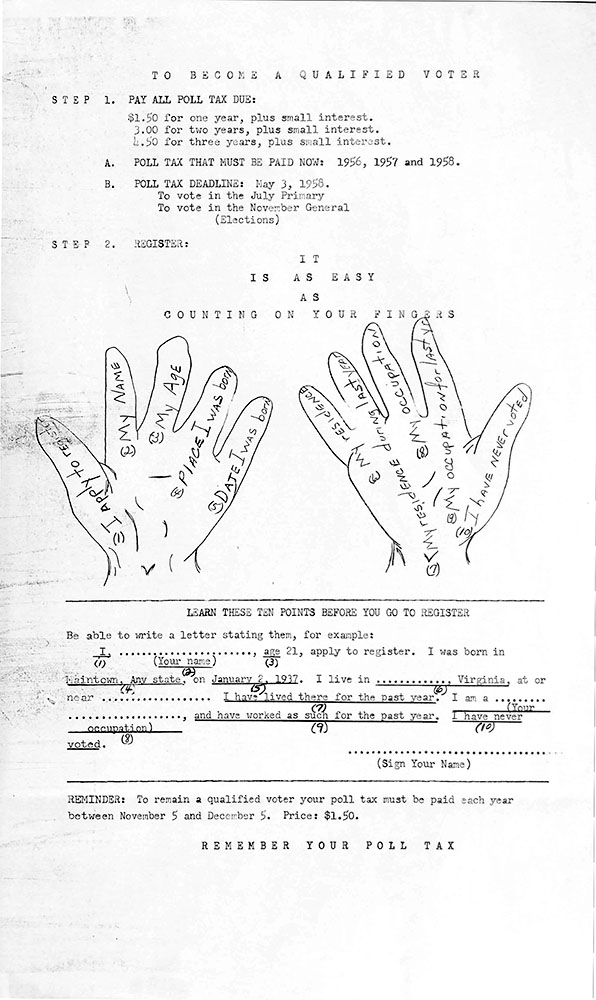

1958 flyer on the 10 points to learn in order to become a qualified voter. View item information in ProjectDAPS.

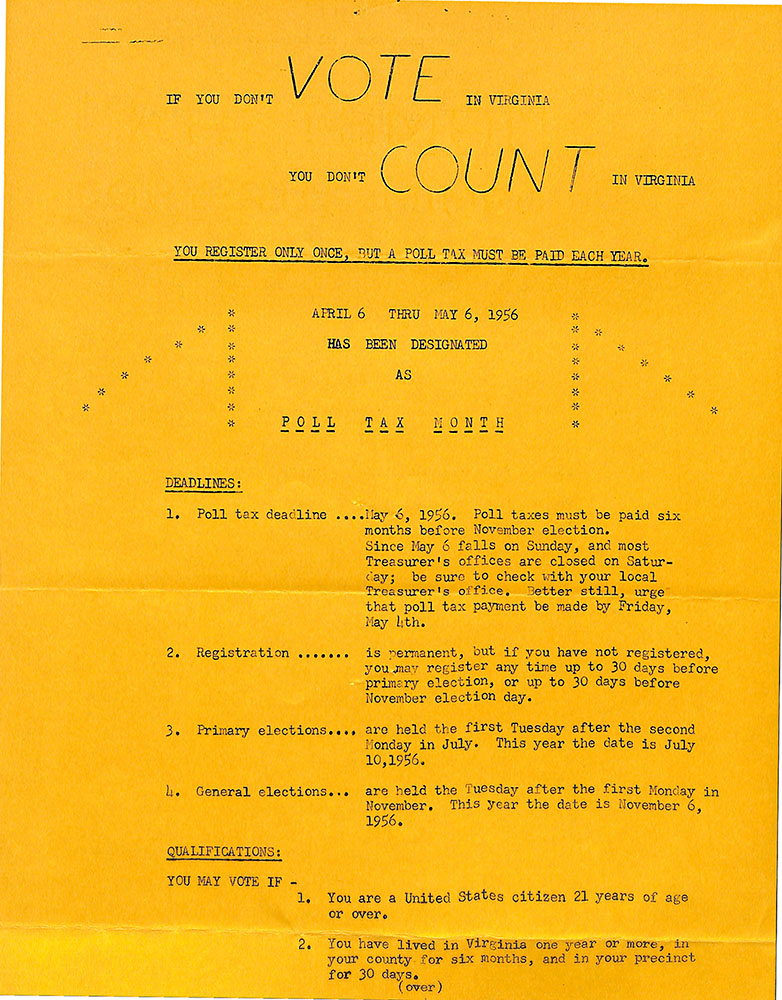

Poll Tax Month: a 1956 Virginia Poll Tax Flyer created by the NAACP, explaining what the poll tax was and how it related to being able to vote in both local and federal elections. View item information in ProjectDAPS.

Portia Haskins of Arlington filed suit against the Virginia Board of Elections and the Arlington County general registrar after she was required to re-register to vote in the November 1965 election despite paying her poll taxes in February and registering for federal elections the previous year.

On April 1, 1966, in Portia A. Haskins v. Levin Nock Davis et al. a Federal District Court ruled in favor of Haskins arguing that “[t]he provisions of Virginia’s dual voter registration…which treat persons who are registered only for federal elections differently from persons registered for all elections violate the equal protection laws of the 14th Amendment.”

To see more items relating to the poll tax, visit the Center for Local History's ProjectDAPS website, or visit the Center for Local History on the first floor of the Central Library.

Do you have a question about this story, or a personal experience to share?

Use this form to send a message to the Center for Local History.

Center For Local History - Blog Post Message Form

Do you have a question about this story, or a personal experience to share? Use this form to send a message to the Center for Local History.

"*" indicates required fields